When you suddenly see the phrase insurance loss reported on a policy paper or vehicle history report, it can quietly shake your heart. The words may look simple, but the confusion they bring is real. Many people pause, wondering if something bad happened, or if they missed an important detail in the past. Understanding the insurance loss reported meaning is not just about insurance terms—it is about peace of mind, clarity, and making confident decisions.

In simple words, this phrase usually means that at some point, an insurance company recorded a claim related to damage, theft, or loss. It does not always mean something serious or dangerous, yet the emotional reaction is natural. Imagine buying a car with excitement, dreaming of new journeys, and then noticing this small line that raises big questions. That moment of doubt is exactly why knowing the insurance loss reported meaning matters so much.

What Is Insurance Loss Reported Meaning in Real Life?

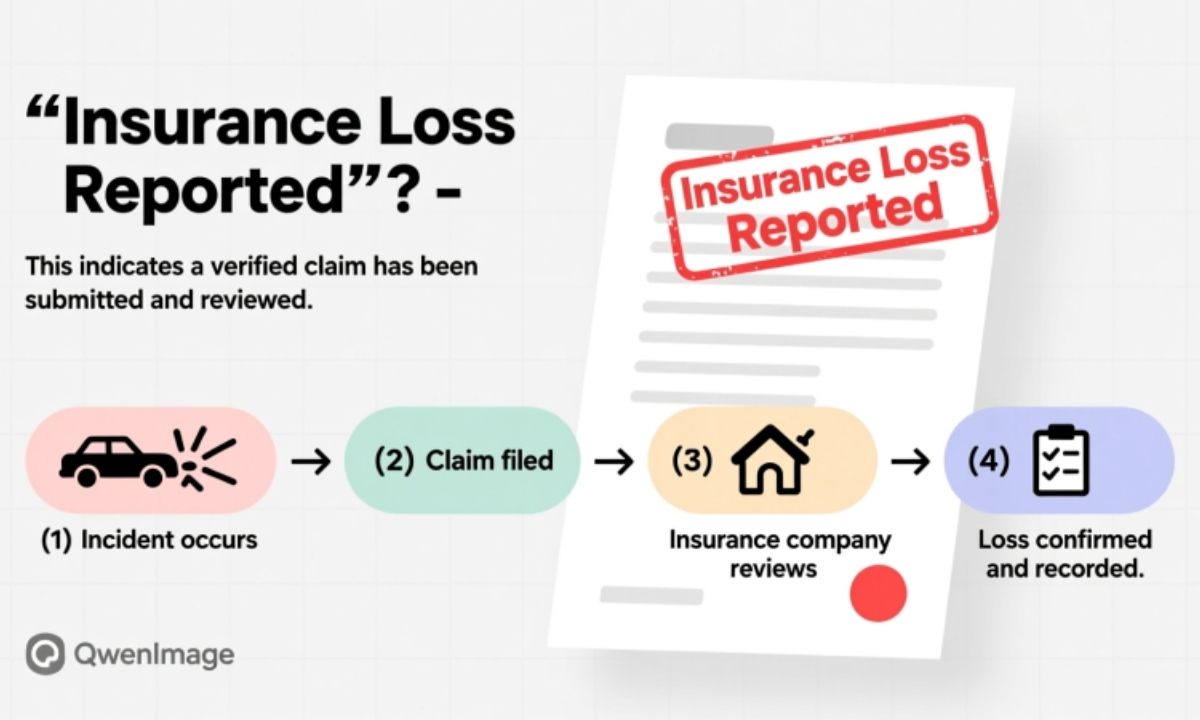

The insurance loss reported meaning in real life simply tells us that an insurance company has recorded a claim in its system. This claim could be related to damage, theft, or even a small accident. For many people, seeing this term feels confusing and emotional. It often creates fear before facts are understood. Knowing the insurance loss reported meaning helps reduce unnecessary stress.

In everyday situations, this term appears when an insurer pays or processes a claim. It does not automatically mean the damage was severe or permanent. Sometimes the claim is very small, like a scratched bumper. Understanding insurance loss reported meaning allows buyers to separate reality from assumptions.

Emotionally, people connect this phrase with loss or risk. But real life is more gentle than that assumption. Many repaired vehicles or policies continue smoothly after a claim. That is why the insurance loss reported meaning should be read calmly, not emotionally.

Real life examples show that one reported loss does not define the future. Insurance records are history, not destiny. Once you truly understand the insurance loss reported meaning, you gain confidence instead of fear.

- Insurance companies record claims officially

- Loss can be minor or major

- Not all reported losses are serious

- Records show history, not current condition

- Buyers often misunderstand this term

- Emotional reactions are common

- Understanding removes fear

Why Does “Insurance Loss Reported” Appear on Records?

The insurance loss reported meaning appears on records because insurers must document every claim. This helps maintain transparency and legal clarity. Even small incidents are recorded for accuracy. Seeing it on records can feel alarming, but it is routine.

Records exist to protect both insurers and consumers. When a claim is filed, details are stored permanently. The insurance loss reported meaning here reflects honesty, not danger. It simply means something was reported at some point.

People often feel anxious when they notice this phrase during purchases. However, records do not judge quality or safety. Understanding the insurance loss reported meaning helps people see records as information tools.

These records help future insurers calculate risk and pricing. They are not meant to scare or shame anyone. With the right knowledge, the insurance loss reported meaning becomes neutral and understandable.

- Claims must be documented

- Records are legally required

- Small incidents are included

- Transparency is the goal

- Records do not equal damage

- Buyers often misread records

- Knowledge reduces anxiety

Insurance Loss Reported Meaning for First-Time Buyers

For first-time buyers, the insurance loss reported meaning can feel overwhelming. Buying insurance or a vehicle is emotional, and unexpected terms create fear. Many beginners think it means hidden damage. In reality, it often does not.

First-time buyers usually lack experience with insurance language. The insurance loss reported meaning sounds serious, but it is often simple. It may relate to a past claim that has already been resolved.

Emotionally, this phrase can pause excitement. A dream purchase suddenly feels risky. Understanding the insurance loss reported meaning helps buyers stay confident and informed.

Education is key for first-time buyers. Once they understand records, decisions become easier. The insurance loss reported meaning becomes information, not a warning sign.

- First-time buyers feel confused

- Term sounds more serious than it is

- Past claims may be resolved

- Emotional fear is natural

- Education builds confidence

- Records do not equal defects

- Calm reading is essential

Is Insurance Loss Reported Always a Bad Sign?

The insurance loss reported meaning is not always negative. Many claims are routine and small. A broken mirror or hail damage can trigger a report. These issues are often fully repaired.

People assume “loss” means destruction. But insurance language uses loss broadly. The insurance loss reported meaning includes minor incidents as well.

Emotionally, humans focus on worst-case scenarios. But logic tells a calmer story. Understanding the insurance loss reported meaning removes unnecessary fear.

In many cases, reported loss shows responsibility. It means the owner used insurance properly. That makes the insurance loss reported meaning neutral, not bad.

- Not always a warning sign

- Minor claims are common

- Repairs may be complete

- Insurance terms sound harsh

- Responsibility is shown

- Logic beats fear

- Context matters most

Emotional Impact: How Insurance Loss Reported Feels

Seeing the insurance loss reported meaning can feel like heartbreak. Excitement turns into doubt instantly. People worry about trust and safety. This emotional reaction is very human.

Insurance language lacks warmth. The insurance loss reported meaning feels cold and technical. Without explanation, emotions take control. Fear grows faster than facts.

Understanding brings emotional relief. Once explained, the insurance loss reported meaning feels lighter. Knowledge replaces anxiety with calm.

Emotion should never guide decisions alone. When balanced with facts, the insurance loss reported meaning becomes manageable.

- Emotional shock is common

- Fear appears instantly

- Language feels harsh

- Facts reduce stress

- Calm thinking helps

- Knowledge is comforting

- Emotions need balance

Insurance Loss Reported Meaning in Vehicle History Reports

In vehicle history reports, the insurance loss reported meaning signals a filed claim. This could be from an accident, weather damage, or theft. It does not describe severity alone.

Vehicle reports show past events, not present condition. The insurance loss reported meaning must be reviewed with inspection results. Context is everything.

Buyers often panic without understanding. Learning the insurance loss reported meaning helps interpret reports correctly.

A professional inspection clarifies reality. The insurance loss reported meaning becomes one piece of a bigger picture.

- Appears in vehicle reports

- Shows filed claims

- Severity varies

- Past vs present difference

- Inspections matter

- Context is essential

- Reports guide decisions

Small Claims vs Big Claims: Does Size Matter?

| Aspect | Small Claims | Big Claims | Does Size Matter? |

| Court Process | Simple, fast, informal procedures | Complex, lengthy, formal litigation | Yes – small claims save time and stress |

| Legal Representation | Often handled without lawyers | Requires professional attorneys | Yes – big claims need expert guidance |

| Filing Costs | Low fees, affordable for most | High costs, expensive legal fees | Yes – small claims are budget-friendly |

| Time to Resolution | Few weeks to months | Months to years | Yes – small claims resolve much faster |

| Evidence Requirements | Basic documentation sufficient | Extensive evidence and discovery | Yes – big claims demand more preparation |

| Monetary Limits | Usually $5,000-$10,000 maximum | Unlimited claim amounts | Yes – determines which court you use |

| Stress Level | Lower stress, casual setting | High stress, intimidating process | Yes – small claims are less overwhelming |

| Appeal Options | Limited or no appeal rights | Full appeal process available | Depends – consider if you need appeals |

| Success Rate | Higher win rate for prepared plaintiffs | Depends on legal team quality | Not really – preparation matters most |

| Settlement Opportunities | Easier informal settlements | Formal mediation and negotiations | No – both allow settlements anytime |

Can Insurance Loss Reported Affect Future Insurance?

The insurance loss reported meaning does play a role when insurance companies review your history in the future. Insurers often look at past claims to understand risk levels. When a loss is reported, it becomes part of your insurance record. This does not automatically mean rejection, but it can influence decisions. Understanding the insurance loss reported meaning helps you stay prepared.

In most cases, a single reported loss does not create serious problems. Insurance companies expect occasional claims because life is unpredictable. The insurance loss reported meaning becomes more important when there are repeated claims in a short time. Patterns matter more than one event. This clarity reduces unnecessary fear.

Emotionally, people worry that one mistake will follow them forever. But insurance systems are more balanced than emotions suggest. The insurance loss reported meaning is reviewed alongside driving behavior, claim type, and time passed. Older claims usually carry less weight. Knowing this brings emotional relief.

Being honest and informed always helps. When you understand the insurance loss reported meaning, you can explain your history confidently. Transparency builds trust with insurers. Instead of fear, knowledge gives you control over future insurance choices.

- Can affect premiums

- Patterns matter more

- Single claim is normal

- Honesty is important

- Preparation helps

- Knowledge gives control

- Risk is evaluated

Insurance Loss Reported Meaning When No Damage Is Visible

Sometimes the insurance loss reported meaning appears even when no damage exists. Claims may involve theft attempts or inspections. Damage may have been repaired.

Visual checks do not show history. The insurance loss reported meaning explains paperwork, not condition.

Understanding prevents confusion. The insurance loss reported meaning is about records, not looks.

Professional evaluation helps confirm reality. The insurance loss reported meaning needs context.

- Damage may be repaired

- Theft claims exist

- Visual checks mislead

- Records show history

- Context is critical

- Inspection helps

- Calm reading matters

How to Check Insurance Loss Reported Details Correctly

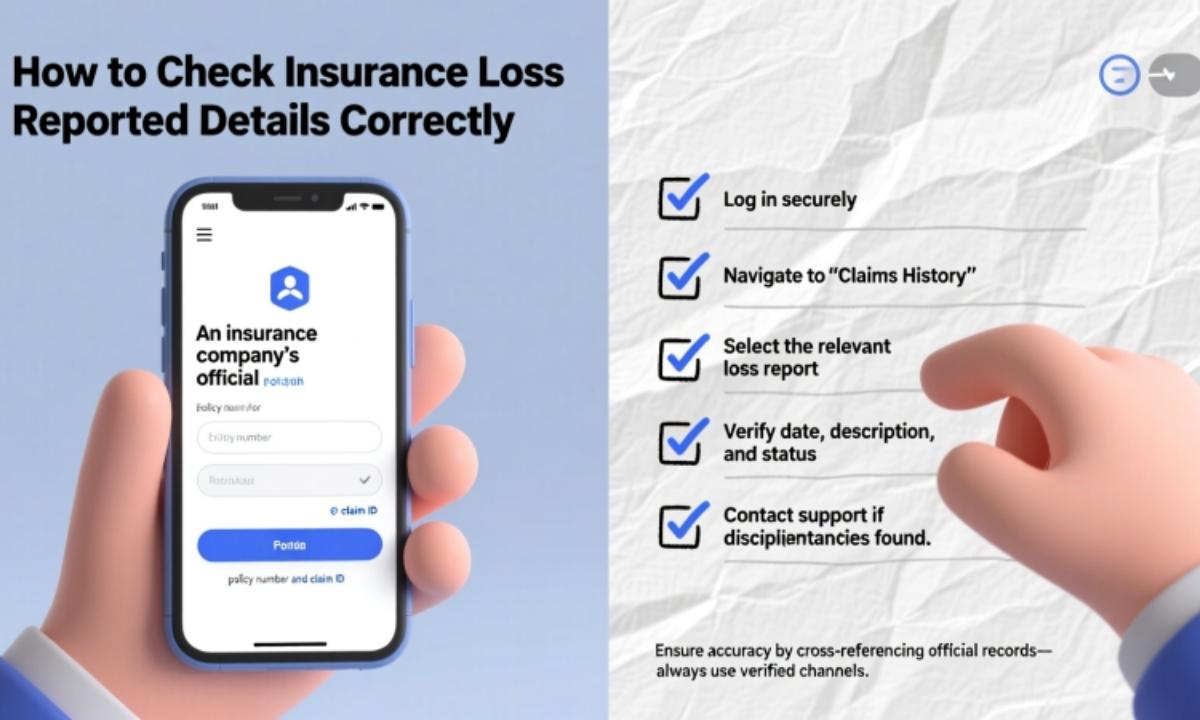

To understand the insurance loss reported meaning, request detailed reports. Ask insurers for claim descriptions. Dates and types matter.

Avoid assumptions. The insurance loss reported meaning requires verification.

Professional help adds clarity. Experts explain the insurance loss reported meaning clearly.

Correct checking leads to confident decisions. Knowledge transforms the insurance loss reported meaning.

- Request full reports

- Check claim type

- Avoid assumptions

- Seek expert advice

- Verify details

- Confidence grows

- Knowledge empowers

Can Insurance Loss Reported Be Removed or Corrected?

The insurance loss reported meaning can sometimes be corrected. Errors happen in records. Proof is required for correction.

Removal depends on accuracy. If valid, the insurance loss reported meaning stays.

Correcting mistakes brings relief. Understanding insurance loss reported meaning helps fight errors.

Always communicate calmly. The insurance loss reported meaning process needs patience.

- Errors are possible

- Proof is required

- Valid claims stay

- Corrections bring relief

- Communication matters

- Patience is needed

- Records can be fixed

What Should You Do After Seeing Insurance Loss Reported?

After seeing the insurance loss reported meaning, pause and breathe. Panic clouds judgment. Gather facts calmly.

Ask questions and review details. The insurance loss reported meaning needs explanation.

Use inspections and reports. Understanding the insurance loss reported meaning brings confidence.

Make decisions with clarity, not fear. Knowledge transforms the insurance loss reported meaning into power.

- Stay calm first

- Gather information

- Ask questions

- Review details

- Use inspections

- Avoid fear-based choices

- Decide confidently

Frequently Asked Questions

What does insurance loss reported meaning actually refer to?

It usually refers to a claim that was filed with an insurance company at some point. The insurance loss reported meaning shows that an incident was officially recorded.

Is insurance loss reported meaning always related to an accident?

Not always, because the insurance loss reported meaning can also involve theft, weather damage, or even minor issues that did not involve an accident.

Can insurance loss reported meaning affect buying a used car?

Yes, the insurance loss reported meaning can influence buyer confidence, but it should always be reviewed along with inspection and repair details.

Does insurance loss reported meaning mean the damage was serious?

No, the insurance loss reported meaning does not automatically indicate serious damage. Many losses are minor and fully repaired.

How long does insurance loss reported meaning stay on records?

The insurance loss reported meaning can stay on records for several years, depending on insurer policies and reporting systems.

Can insurance loss reported meaning increase insurance premiums?

Sometimes it can, but usually only if there are multiple claims. A single insurance loss reported meaning rarely causes a big increase.

Is insurance loss reported meaning the same as total loss?

No, the insurance loss reported meaning does not always mean a total loss. Total loss is a separate and more severe category.

Can insurance loss reported meaning be a reporting error?

Yes, mistakes can happen, and the insurance loss reported meaning can sometimes appear due to incorrect or outdated information.

How can I verify insurance loss reported meaning details?

You can request claim details from the insurer to fully understand the insurance loss reported meaning and what caused it.

Does insurance loss reported meaning affect future insurance approval?

It can be reviewed during applications, but the insurance loss reported meaning alone usually does not block approval.

Should I worry if I see insurance loss reported meaning on my record?

You should review it calmly, because the insurance loss reported meaning is informational and not always a warning sign.

Conclusion

Understanding the insurance loss reported meaning brings clarity where fear often begins. These few words can feel heavy at first, but once you look deeper, they simply tell a story from the past—not a judgment about the present. A reported loss is often just a record of responsibility, not a sign of danger. When you truly understand the insurance loss reported meaning, you stop letting assumptions control your emotions.

Life is full of small incidents, and insurance exists to support us during those moments. A single claim does not define a person, a vehicle, or a future insurance decision. The insurance loss reported meaning becomes less intimidating when you see it as information rather than a warning. With knowledge, fear slowly turns into confidence.

Tariq is a dedicated blogger with 4 years of experience in the field of name-related blogs. Over the years, he has researched and written extensively about baby names, business names, and creative ideas that inspire identity and uniqueness. His content has helped readers across the globe discover meaningful and memorable names.

Currently, Tariq is working on SmartsName.com, where he continues to share his passion for names. With his knowledge and expertise, he aims to provide readers with unique, creative, and valuable suggestions that make the journey of choosing the perfect name easier and more enjoyable.